Your accounting method determines in which month the expenses are recorded. To illustrate this, let’s say an employee of yours is purchasing supplies for a staff party in June, for which they’ll be reimbursed on their July paycheck.

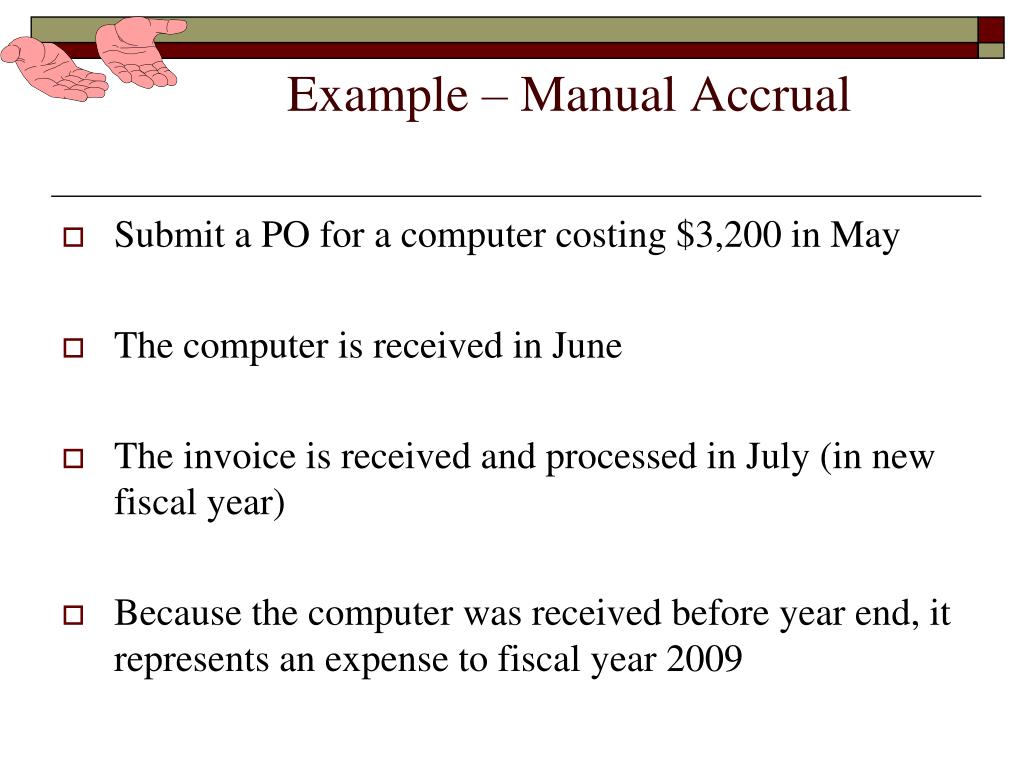

This happens when you are expecting revenue to actually be billed, or supplier invoices to actually arrive, in the next reporting period.

Accrual entry software#

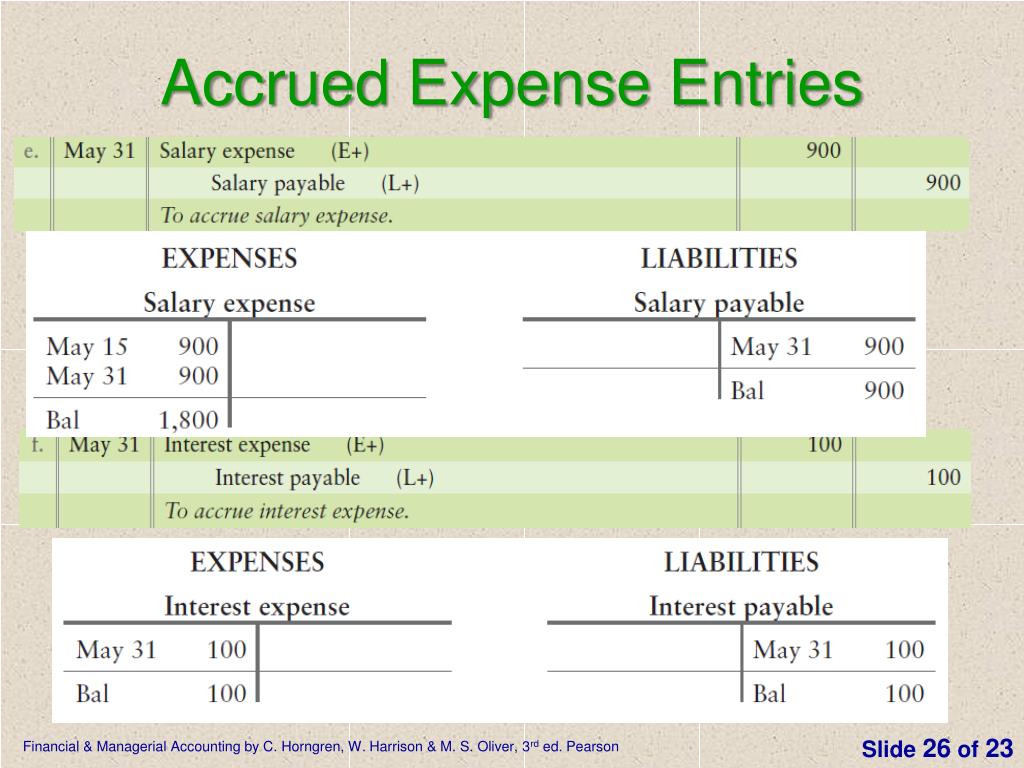

Most accruals are initially created as reversing entries, so that the accounting software automatically cancels them in the following month. Very few accruals ever impact the long-term asset or long-term liability portions of the balance sheet. Thus, the effect of an accrual entry is that a change will occur in the balance sheet, as well as the income statement. The offset to accrued revenue is an accrued asset account (such as Unbilled Consulting Fees), which also appears in the balance sheet, and probably as a current asset. In double-entry bookkeeping, the offset to an accrued expense is an accrued liability account, which appears in the balance sheet, probably as a current liability. Impact of Accruals on the Financial Statements Using accruals minimizes the risk of having residual elements of business transactions appear in subsequent financial statements. This results in higher-quality financial statements that incorporate all aspects of a firm’s business transactions. Using accruals allows a business to more closely adhere to the matching principle, where revenues and related expenses are recognized together in the same period.

To fully record the wage expense for the entire month, it also accrues $32,000 in additional wages, which represents the cost of wages for the remaining days of the month. The invoice from the bank for $3,000 in interest expense does not arrive until the following month, so the company accrues the expense in order to show the amount on its income statement in the proper month.Ī company pays its employees at the end of each month for their hours worked through the 25th day of the month. Expense AccrualĪ company has a loan with the local bank for $1 million, and pays interest on the loan at a variable rate of interest. It can record an accrual in the current period, so that its current income statement shows $5,000 of revenue, even though it has not yet billed the client. Revenue AccrualĪ consulting company works billable hours on a project that it will eventually bill to a client for $5,000.

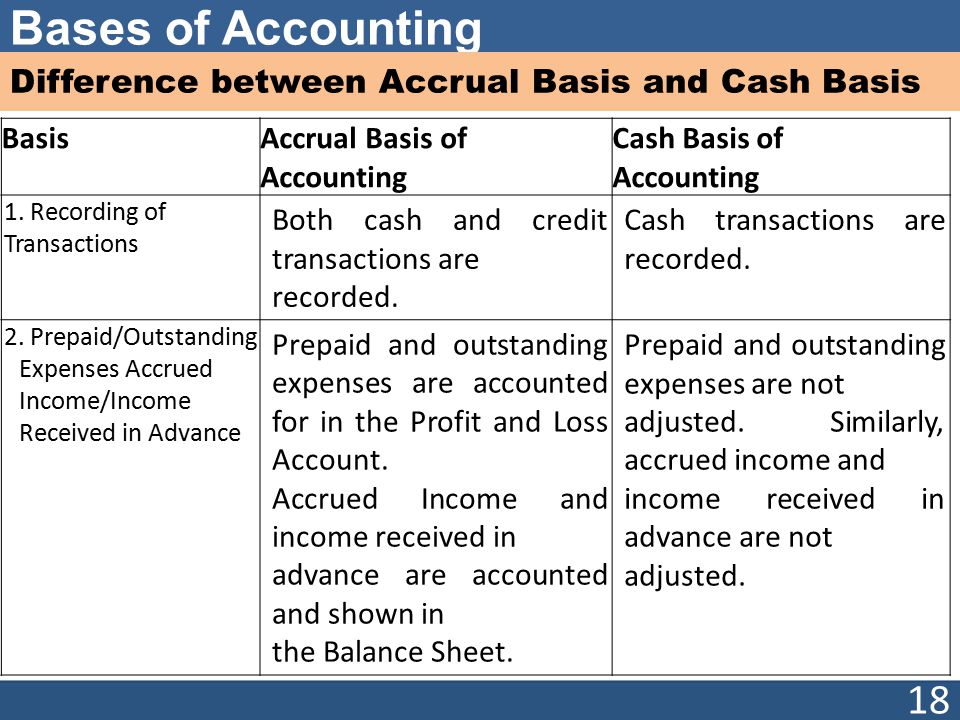

It is nearly impossible to generate financial statements without using accruals, unless the cash basis of accounting is used. It is an essential element of the accrual basis of accounting. An accrual allows a business to record expenses and revenues for which it expects to expend cash or receive cash, respectively, in a future period.

0 kommentar(er)

0 kommentar(er)